Difference Between Mpers And Mfrs

Transition from pers to mpers as well as touching on the differences between mpers and mfrs.

Difference between mpers and mfrs. Revenue from contracts with customers was introduced by the malaysian accounting standards board to provide one comprehensive revenue recognition model for all contracts with customers to improve comparability within industries across industries and across capital markets. However under mpsas an entity has to determine whether the asset is a cash generating1 or non cash generating2 asset. Malaysian financial reporting standard mfrs 15. Mfrs 108 accounting policies changes in accounting estimates and errors provides a basis for selecting and applying accounting policies in the absence of explicit guidance.

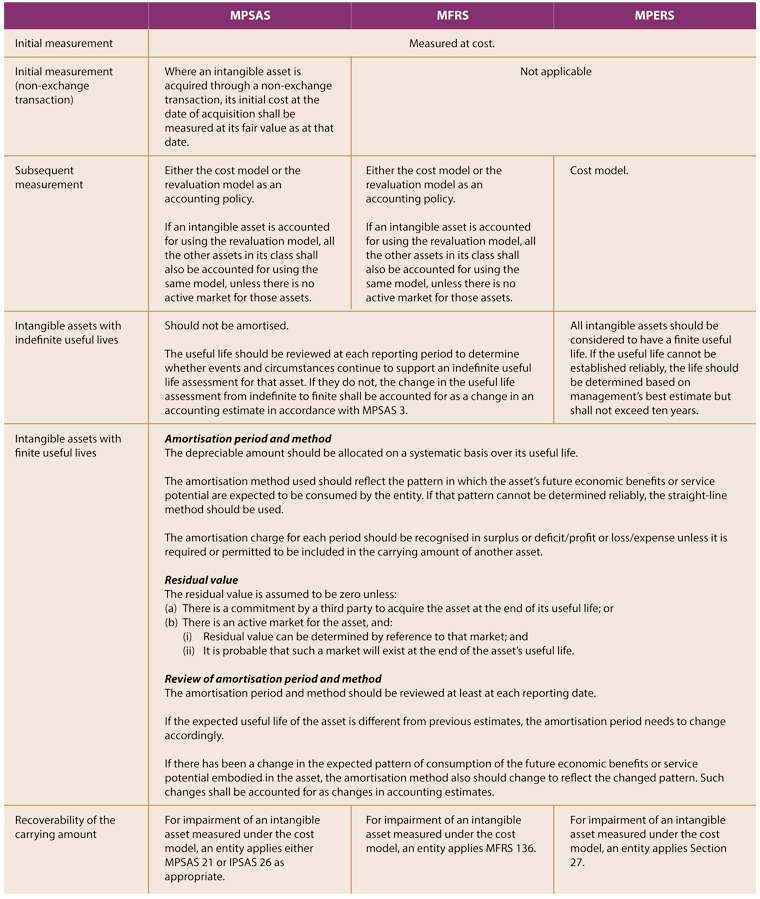

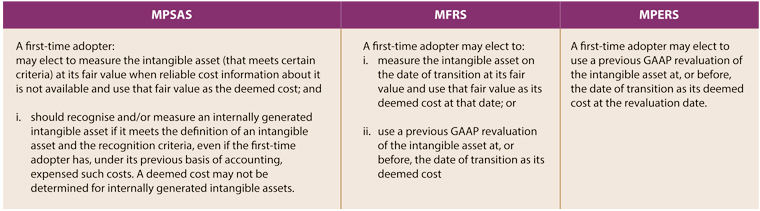

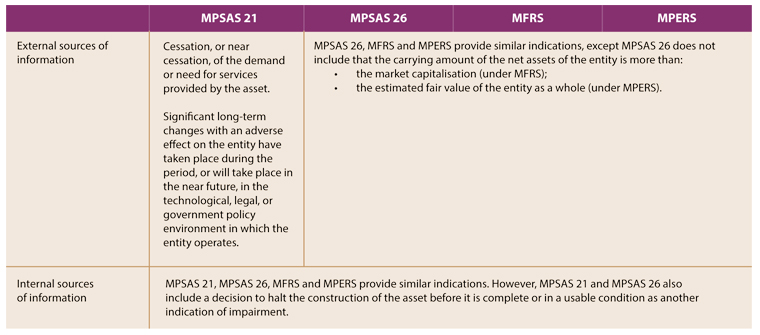

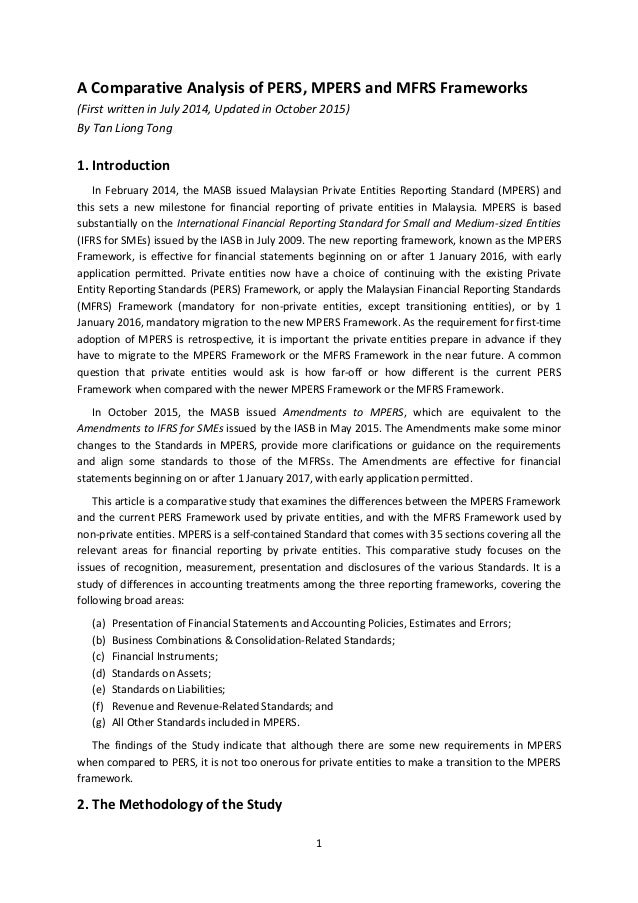

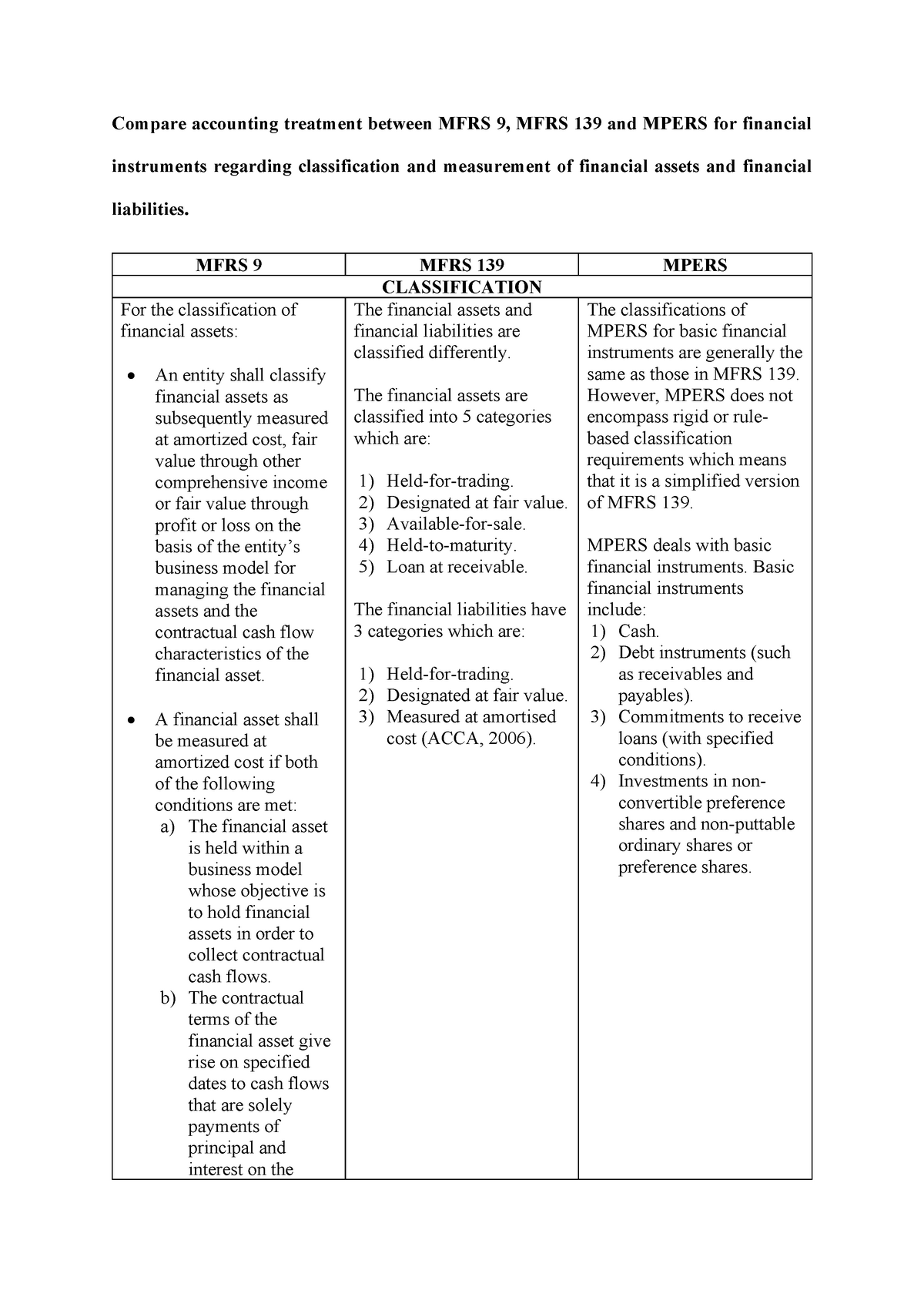

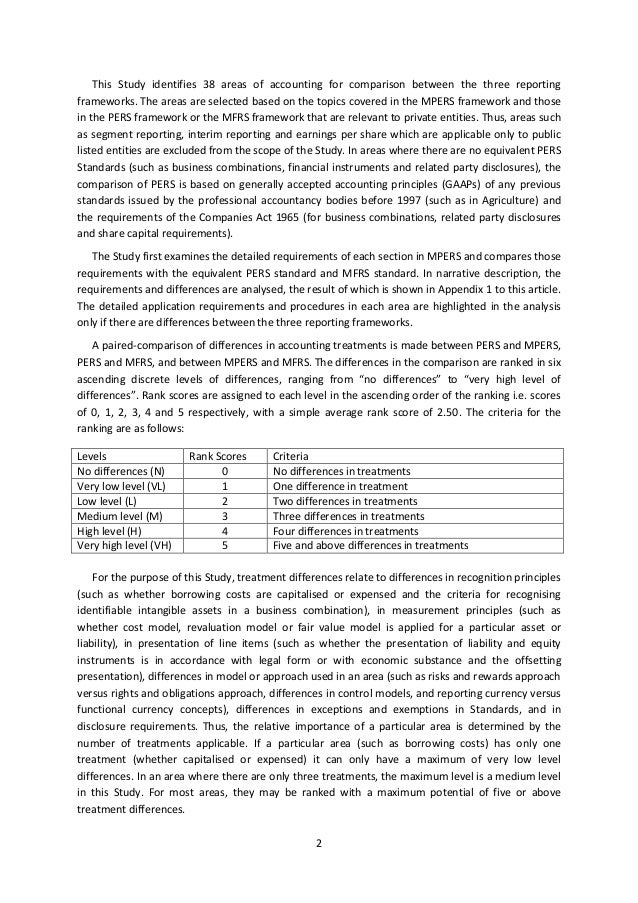

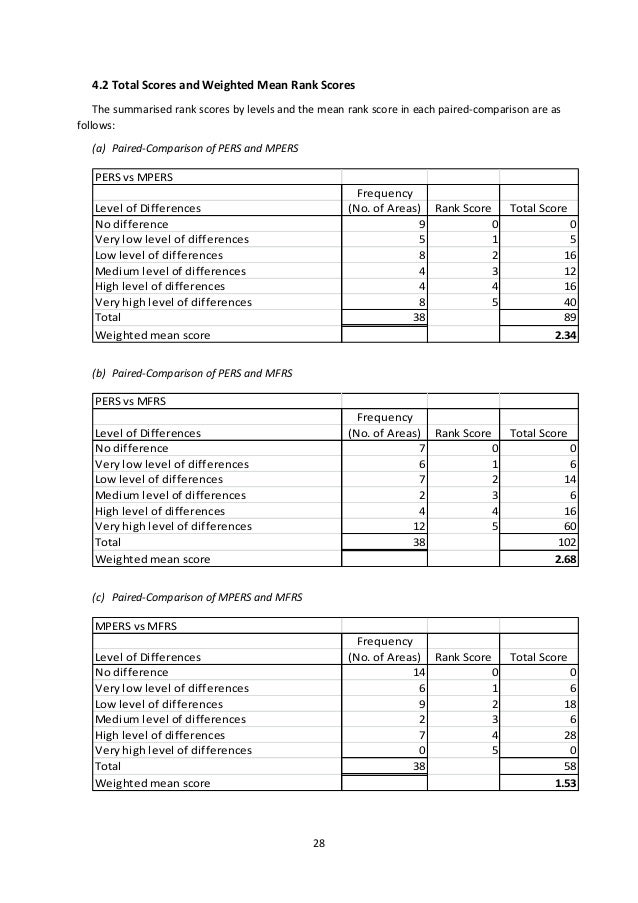

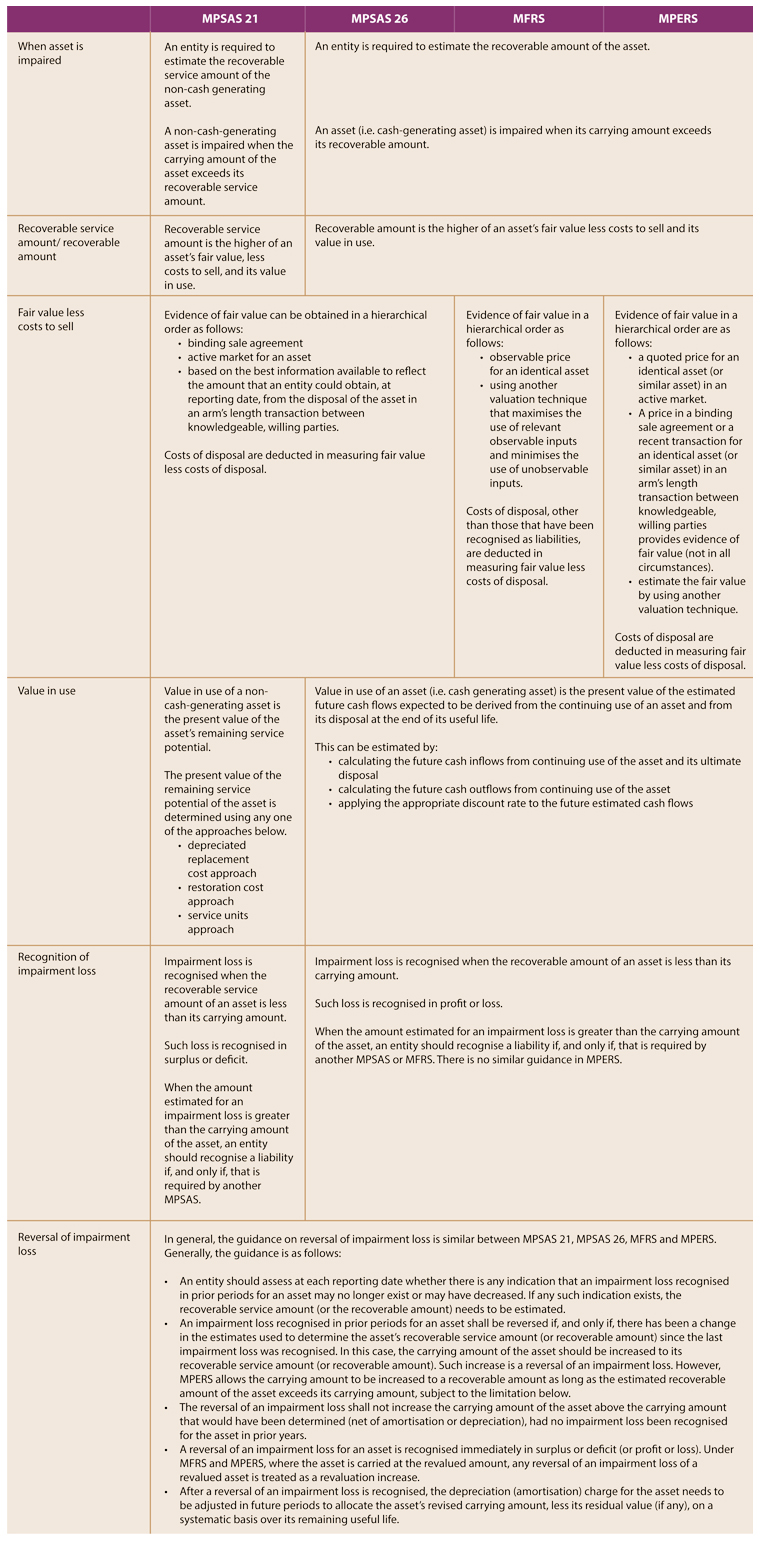

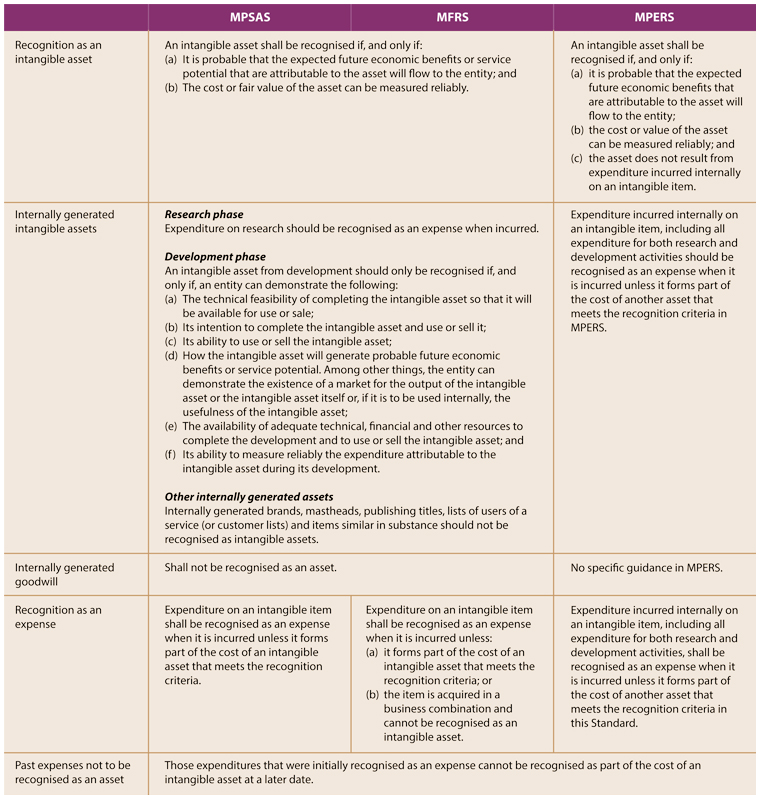

Mpers is a self contained standard that comes with 35 sections covering all the. If the asset is a cash generating asset the entity applies the requirements in mpsas 26 impairment of cash generating assets which are similar to mpers and mfrs with no significant differences noted. This article is a comparative study that examines the differences between the mpers framework and the current pers framework used by private entities and with the mfrs framework used by non private entities. The next question you may be asking what are the key differences between the existing financial reporting standards frs and the new mfrs.

Provide an understanding of the convergence process and transition from private entity reporting standards date and venue g hotel penang ballroom 1 level 2 basic module 23 24 may 2016. For impairment both mpers and mfrs have similar requirements. Hence if the parent adopts mfrs and adopts the cost model. Mpers is based substantially on the international financial reporting standard for small and medium sized entities ifrs for smes issued by the iasb in july 2009.

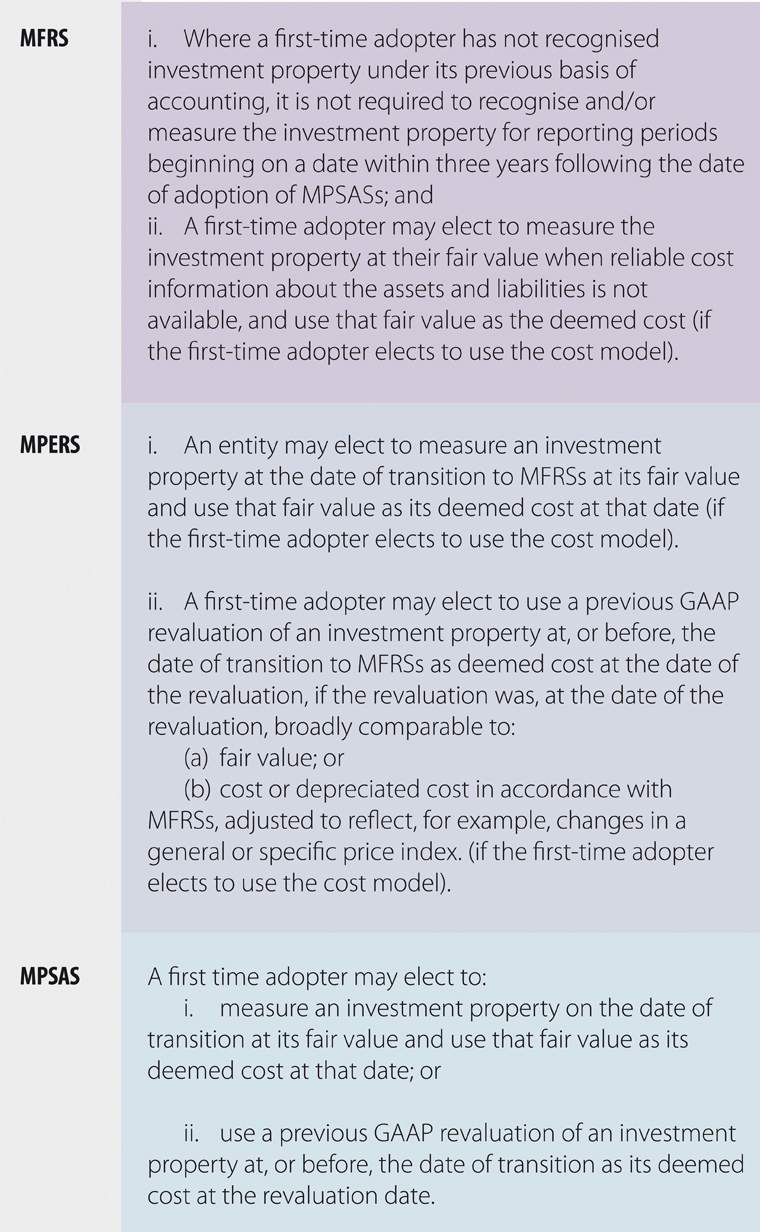

It highlights some of the key differences with the malaysian financial reporting standards mfrs and the private entities reporting standards pers and analyses the key principles upon first time adoption of the mpers. An identified asset may be explicitly or implicitly specified in a contract. What s next for private entities mpers or mfrs. Ey partner hoh yoon hoong suggested that companies consider the major differences between mpers and mfrs.

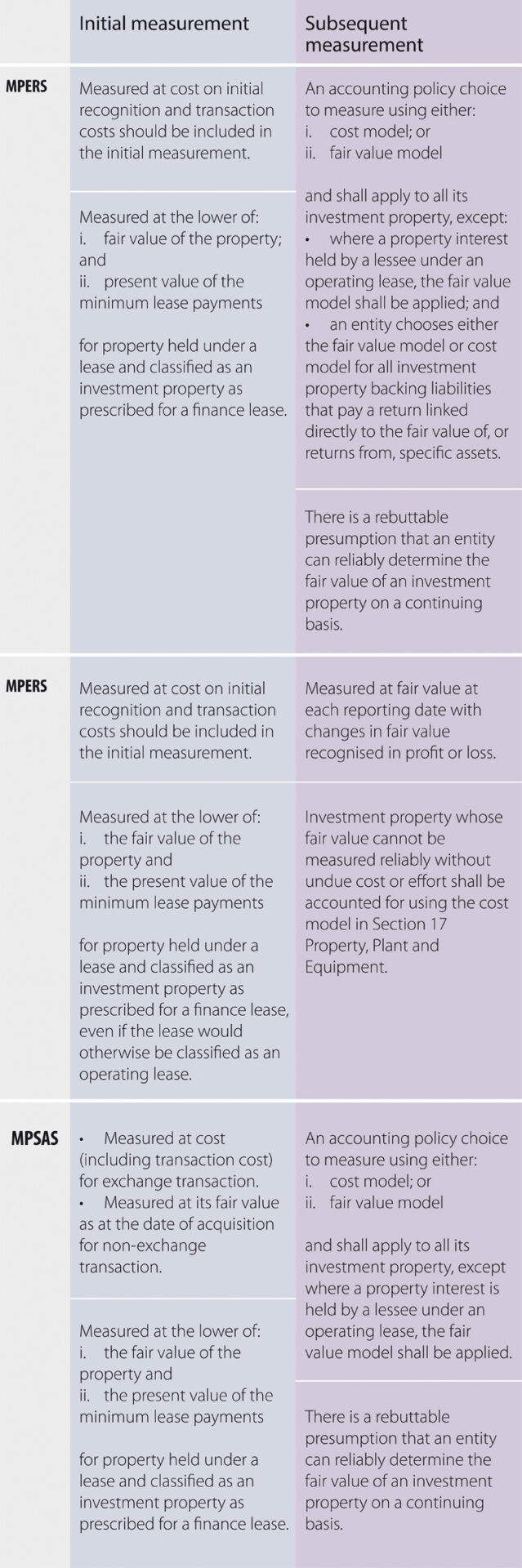

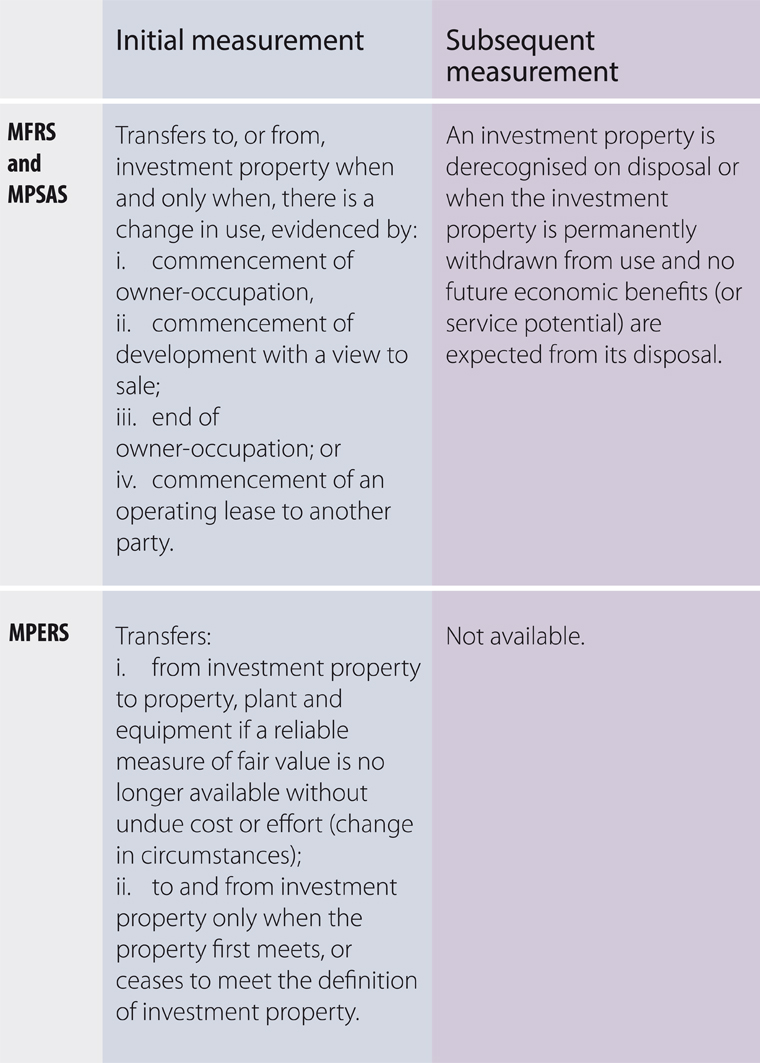

In february 2014 the masb issued malaysian private entities reporting standard mpers and this sets a new milestone for financial reporting of private entities in malaysia. Get ready for mfrs 16 a new accounting standard for leases 4 a lease conveys the right to control the use of an identified asset for a period of time in exchange for consideration. For example in the case of investment property mfrs allows for two models the cost model or fair value model but mpers only allows fair value model hoh said. Comparison of perss mpers and mfrss in malaysia.